See Our Latest Blogs

Explore expert insights, tips, and updates in our latest property investment blog posts.

08 Essential Tips for First-Time Homebuyers

Buying your first home is an exciting milestone, but it can also feel overwhelming without the right guidance. From understanding your budget to navigating the complex buying process, there are many factors to consider. By taking the right steps and being prepared, you can avoid common pitfalls and make the journey to homeownership smooth and successful. Here are 10 essential tips to help first-time homebuyers find the perfect home with confidence.

1. Determine Your Budget

Before starting your home search, it's crucial to know how much you can afford. Take a close look at your monthly income, expenses, and savings to calculate a realistic budget. Experts recommend following the 28/36 rule: allocate no more than 28% of your gross income to housing costs and keep your total debt-to-income ratio under 36%. Don’t forget to factor in property taxes, insurance, and maintenance costs. Knowing your budget upfront will help you focus on homes within your price range and avoid financial strain.

2. Get Pre-Approved for a Mortgage

A mortgage pre-approval is an important step in the home-buying process. It shows sellers that you are a serious buyer and gives you a clear understanding of your borrowing capacity. To get pre-approved, you’ll need to provide documentation such as proof of income, tax returns, and credit history. A pre-approval also allows you to lock in a favorable interest rate. With this in hand, you can confidently make offers and avoid delays in the buying process.

3. Research Neighborhoods Thoroughly

Location is just as important as the house itself. Spend time researching neighborhoods to find one that suits your lifestyle and needs. Consider factors like proximity to work, schools, public transportation, and amenities such as parks and shopping centers. Visit potential neighborhoods at different times of the day to get a feel for the environment. A home in a great location can also retain its value better over time, making it a smarter investment.

4. Work with a Trusted Real Estate Agent

A knowledgeable real estate agent is your best ally in the home-buying process. They can provide valuable insights into the market, help you find homes that meet your criteria, and negotiate on your behalf. Choose an agent with experience in your target area and excellent reviews from past clients. A good agent will guide you through every step of the process, from house hunting to closing, ensuring a smooth and stress-free experience.

5. Understand the Home Inspection Process

A home inspection is a critical step to ensure the property is in good condition and free from major issues. Hire a professional home inspector to evaluate the structure, plumbing, electrical systems, roof, and more. If the inspection reveals problems, you can negotiate repairs or a lower price with the seller. Skipping this step can lead to costly surprises down the road. Remember, an inspection is an investment in your future peace of mind.

6. Avoid Emotional Purchases

It’s easy to fall in love with a home that has stunning features or beautiful decor, but don’t let emotions drive your decision. Stay focused on your priorities, such as the size, layout, and location of the property. Make sure the home meets your long-term needs and fits your budget. Remember, it’s better to take your time and find the right house than to rush into a purchase you might regret later.

7. Plan for Closing Costs

Many first-time buyers overlook the additional expenses involved in buying a home. Closing costs typically range from 2% to 5% of the purchase price and may include fees for the loan, appraisal, home inspection, title insurance, and more. Ask your lender for a detailed breakdown of these costs upfront so you can budget accordingly. Setting aside funds for closing costs ensures you’re financially prepared when it’s time to finalize your purchase.

8. Prioritize Your Must-Haves

Before starting your home search, make a list of your non-negotiables, such as the number of bedrooms, outdoor space, or proximity to work. This helps you stay focused and avoid being distracted by homes that don’t meet your core needs. It’s also helpful to separate “must-haves” from “nice-to-haves,” so you can make practical decisions without compromising on what matters most.

Realize Your Vision, Own The Space.

Claude R. Trotter, III

Renaissance Capital Group exceeded expectations on our DFW commercial project. Their fantastic team communicated brilliantly and worked tirelessly through challenges, delivering on time and on budget. Highly recommend!

Dr. Andrea Long-Nelson

Our school facility project exceeded expectations thanks to Renaissance Capital Group. Their team understood educational needs, communicated clearly with administration, and navigated regulatory challenges seamlessly. Delivered on schedule and budget—trustworthy partners.

Gabe Monticue

I've worked with Dr. David L. Willis at Renaissance Capital Group for years, and his authenticity and real estate expertise are unmatched. David consistently keeps his word, demonstrating integrity in every interaction. His client commitment makes him invaluable.

Get In Touch

Email: [email protected]

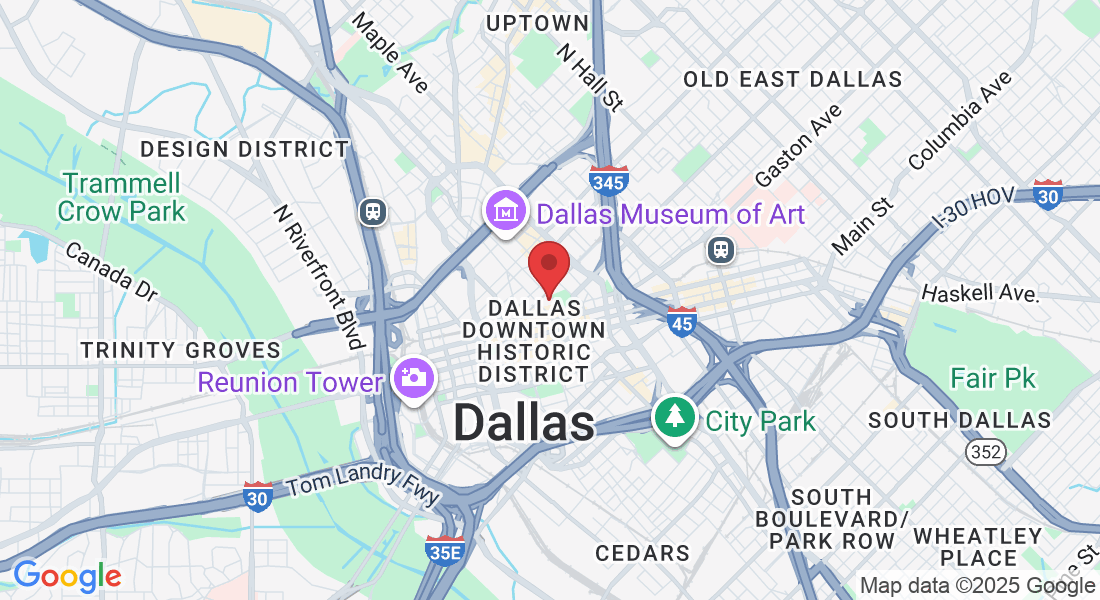

Address

Office: 325 North St. Paul, Suite 3100, Dallas Texas 75201

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

(972) 896-0381

Realize Your Vision, Own The Space.

Turn your vision into reality. Own the space.

© 2026 Renaissance Capital Group - All Rights Reserved. Invest Smart, Grow Strong, Build Your Future. Website created by EBA - Education & Business Automation