See Our Latest Blogs

Explore expert insights, tips, and updates in our latest property investment blog posts.

HUD 223(f) vs. 221(d)(4): Which Multifamily Loan Program Is Right for Your Investment?

As a multifamily investor, choosing the right HUD financing program can significantly impact your project's profitability and long-term success. While both HUD 223(f) and HUD 221(d)(4) offer exceptional terms and benefits, they serve distinctly different investment strategies. Understanding the nuances between these two flagship programs is essential for making informed financing decisions that align with your investment goals.

Understanding the Fundamental Difference

The primary distinction between these programs comes down to one essential question: Are you acquiring or refinancing an existing property, or are you building something new?

HUD 223(f) is designed exclusively for the acquisition or refinancing of existing multifamily properties that are at least three years old and substantially complete. This program is perfect for investors looking to purchase stabilized assets or refinance existing debt to improve cash flow.

HUD 221(d)(4) finances new construction and substantial rehabilitation of multifamily properties. If you're building from the ground up or undertaking renovations that exceed simple repairs and maintenance, this is your program.

Leverage Comparison: How Much Can You Borrow?

When it comes to loan-to-value ratios, both programs offer competitive leverage, but with different parameters.

HUD 223(f) provides up to 85% LTV for market-rate properties and up to 87% for affordable housing projects. For refinancing scenarios, you can often access 80% of the property's appraised value. This translates to meaningful equity extraction opportunities when refinancing appreciated properties or reasonable down payment requirements for acquisitions.

HUD 221(d)(4) offers superior leverage at up to 90% loan-to-cost for substantial rehabilitation projects and even higher for new construction with affordable housing components. This higher leverage is particularly attractive for developers and value-add investors who want to maximize capital efficiency while undertaking significant improvements or new development.

Timeline and Process Considerations

The timeline difference between these programs is substantial and should factor heavily into your decision-making.

HUD 223(f) Timeline: From application to closing, expect approximately five to seven months. The process is relatively streamlined because you're dealing with an existing, operational property. Property condition assessments focus on immediate needs rather than hypothetical construction scenarios, and underwriting centers on actual historical performance rather than projected future performance.

HUD 221(d)(4) Timeline: Plan for nine to twelve months or longer from initial application to construction closing. This extended timeline accounts for the complexity of construction underwriting, detailed architectural review, and the establishment of construction escrows and payment procedures. However, this investment in time often pays dividends through more comprehensive financing and better long-term terms.

For investors evaluating time-sensitive opportunities, these timeline differences can be deal-making or deal-breaking factors.

Interest Rates and Terms Structure

Both programs offer remarkably attractive financing terms, though with subtle differences.

HUD 223(f) provides fixed interest rates for terms up to 35 years, with loan amounts starting at $2 million. The rates are typically based on Treasury yields plus a spread, resulting in some of the most competitive permanent financing available in the market. The monthly mortgage insurance premium generally ranges from 0.45% to 0.70% annually, depending on your loan-to-value ratio.

HUD 221(d)(4) offers even longer terms—up to 40 years—with similarly competitive fixed rates. The extended term provides additional cash flow benefit during the critical stabilization period following construction completion. The mortgage insurance premium structure is similar, though construction loans include additional complexity with separate construction and permanent loan phases.

Property Condition and Rehabilitation Limits

This is where the programs diverge most significantly and where your property's condition determines program eligibility.

When to Choose HUD 223(f): Your property must be in good condition, typically requiring less than $15,000 per unit in immediate repairs. The program allows for critical repairs and moderate improvements but isn't designed for major renovations. If you're looking at a property that needs a new roof, HVAC upgrades, and unit refreshes—but the bones are solid and it's currently operational—223(f) likely fits.

When to Choose HUD 221(d)(4): If your project requires substantial rehabilitation exceeding 15% of the property's value, or if you're building new construction, you must use 221(d)(4). This program is built for transformative projects: adding new buildings, completely renovating existing structures, or ground-up development.

Cash Flow and Operational Considerations

The operational requirements differ meaningfully between programs, affecting your investment strategy.

With HUD 223(f), you're acquiring or refinancing a stabilized asset that must demonstrate at least 90% occupancy for market-rate properties. The cash flow is typically immediate, and underwriting focuses on historical operating performance. This makes the program ideal for investors seeking immediate income and proven operating metrics.

HUD 221(d)(4) requires you to navigate a construction period with different cash flow dynamics. You'll have interest-only payments during construction, followed by a stabilization period where you're working toward projected occupancy and rental rates. While riskier, this structure offers the potential for higher returns if you can execute effectively and achieve or exceed your underwritten projections.

Making Your Decision

The choice between HUD 223(f) and 221(d)(4) ultimately depends on your investment strategy, risk tolerance, and specific project characteristics.

Choose HUD 223(f) if you:

Are acquiring or refinancing an existing, stabilized property

Want faster closing timelines (5-7 months)

Prefer immediate cash flow with proven operating history

Need to complete only moderate improvements or repairs

Seek lower execution risk with established occupancy

Choose HUD 221(d)(4) if you:

Are developing new construction or substantial rehabilitation

Can accommodate longer timelines (9-12+ months)

Want maximum leverage (up to 90% LTC)

Have construction management experience or strong general contractor relationships

Are comfortable with lease-up risk and stabilization periods

The Bottom Line

Both HUD 223(f) and 221(d)(4) represent some of the most powerful financing tools available to multifamily investors. Neither is inherently superior; rather, each excels in its specific use case. The key is honestly assessing your project's characteristics, your team's capabilities, and your investment timeline to determine which program aligns with your objectives.

Many successful investors use both programs strategically across their portfolios—223(f) for stable acquisitions that generate immediate returns, and 221(d)(4) for development projects that offer higher return potential through value creation. By understanding the strengths and requirements of each program, you can make informed decisions that maximize your multifamily investment success.

Realize Your Vision, Own The Space.

Claude R. Trotter, III

Renaissance Capital Group exceeded expectations on our DFW commercial project. Their fantastic team communicated brilliantly and worked tirelessly through challenges, delivering on time and on budget. Highly recommend!

Dr. Andrea Long-Nelson

Our school facility project exceeded expectations thanks to Renaissance Capital Group. Their team understood educational needs, communicated clearly with administration, and navigated regulatory challenges seamlessly. Delivered on schedule and budget—trustworthy partners.

Gabe Monticue

I've worked with Dr. David L. Willis at Renaissance Capital Group for years, and his authenticity and real estate expertise are unmatched. David consistently keeps his word, demonstrating integrity in every interaction. His client commitment makes him invaluable.

Get In Touch

Email: [email protected]

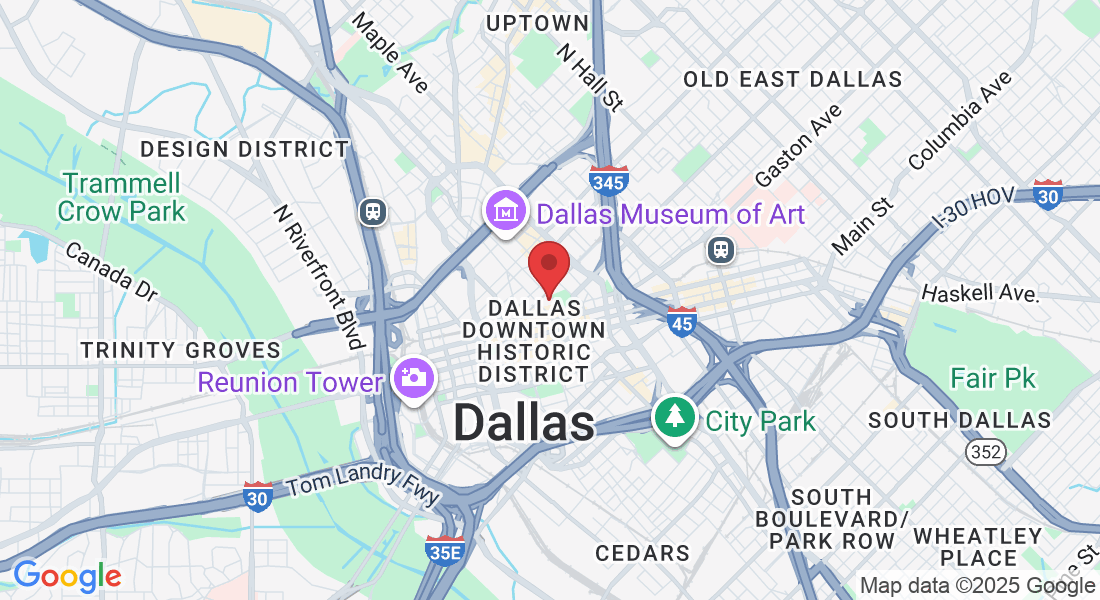

Address

Office: 325 North St. Paul, Suite 3100, Dallas Texas 75201

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

(972) 896-0381

Realize Your Vision, Own The Space.

Turn your vision into reality. Own the space.

© 2026 Renaissance Capital Group - All Rights Reserved. Invest Smart, Grow Strong, Build Your Future. Website created by EBA - Education & Business Automation