See Our Latest Blogs

Explore expert insights, tips, and updates in our latest property investment blog posts.

Navigating the HUD Commercial Financing Process: Timeline, Requirements, and What to Expect

Navigating the HUD Commercial Financing Process: Timeline, Requirements, and What to Expect

Securing HUD commercial financing represents one of the most strategic decisions you can make for your multifamily or healthcare real estate project. However, many investors hesitate to pursue HUD loans due to perceived complexity or lengthy timelines. While HUD financing does require thorough preparation and patience, understanding the process demystifies it and reveals that each step serves a purpose in securing optimal long-term financing.

This comprehensive guide walks you through the entire HUD financing journey, from initial concept to closing, helping you set realistic expectations and prepare effectively for each phase.

Phase One: Pre-Application and Preparation (Weeks 1-8)

The foundation of a successful HUD loan application is built long before you submit formal paperwork. This crucial phase determines whether your project is a good fit for HUD financing and assembles the team and documentation necessary for a smooth process.

Assemble Your Professional Team Begin by selecting an experienced HUD lender or mortgage banker. Not all commercial lenders handle HUD financing, and those who do vary significantly in their expertise and processing efficiency. Look for lenders with demonstrated track records in HUD loans, particularly in your specific program (223(f), 221(d)(4), 232, etc.) and property type.

You'll also need qualified legal counsel familiar with HUD transactions, a reputable general contractor for construction projects, and experienced property management if you're not managing the asset yourself. HUD scrutinizes the entire team's qualifications, so assembling experienced professionals from the outset strengthens your application.

Initial Feasibility Analysis Work with your lender to conduct a preliminary feasibility assessment. This involves reviewing your property or project plans, analyzing local market conditions, examining your financial capacity, and determining which HUD program best fits your needs. Many lenders will provide a preliminary assessment at no cost, helping you determine if HUD financing makes sense for your particular situation.

Document Preparation Start gathering the extensive documentation HUD requires. For existing properties, you'll need three years of operating statements, rent rolls, current and historical tax returns, and property condition reports. For new construction, prepare detailed project budgets, development timelines, architectural plans, and market feasibility studies.

Personal and entity financial documentation is equally important: personal financial statements, three years of personal and entity tax returns, organizational documents for your borrowing entity, and detailed resumes highlighting relevant real estate experience.

Phase Two: Formal Application and Initial Underwriting (Weeks 9-16)

Once you've completed your pre-application preparation, you're ready to submit your formal application and pay the application fee, which typically ranges from $10,000 to $30,000 depending on loan size and complexity.

HUD Application Submission Your lender will prepare and submit the formal HUD application package, including Form 92013 (Application for Multifamily Housing Project), detailed project narratives, all financial documentation, preliminary architectural plans for construction projects, and market analysis data.

Third-Party Reports Ordered During this phase, your lender orders crucial third-party reports that HUD requires for underwriting. The property appraisal establishes fair market value or projected value upon completion. Phase I environmental assessments identify any environmental concerns. Property condition assessments detail the physical condition and identify necessary repairs. Market studies validate demand and rental rate assumptions.

These reports typically take 4-8 weeks to complete and represent a significant cost, often totaling $50,000-$100,000 or more for larger projects. However, they're essential to HUD's underwriting process and provide you with valuable due diligence on your investment.

Initial HUD Review HUD's underwriters begin their preliminary review, examining the completeness of your application, the strength of your borrower profile and experience, the feasibility of your financial projections, and the quality of the market and property fundamentals. This initial review often generates questions or requests for additional information, which is a normal part of the process.

Phase Three: Detailed Underwriting and Due Diligence (Weeks 17-24)

This middle phase represents the heart of HUD's underwriting process, where detailed analysis occurs and conditions are established for loan approval.

Comprehensive Financial Analysis HUD underwriters conduct detailed analysis of your project's financial feasibility, including debt service coverage ratios, operating expense assumptions, rental income projections, and reserve requirements. For construction projects, they scrutinize construction budgets, development timelines, contractor qualifications, and lease-up assumptions.

Architectural and Engineering Review For new construction and substantial rehabilitation, HUD's architectural team reviews all plans and specifications in detail, ensuring compliance with HUD's minimum property standards, local building codes and zoning requirements, accessibility requirements (ADA compliance), and energy efficiency standards.

This architectural review can be one of the most time-consuming aspects of HUD financing for construction projects. Be prepared for multiple rounds of plan revisions and clarifications as HUD ensures every aspect of your project meets their requirements.

Addressing Underwriter Questions Throughout this phase, expect regular communication with underwriters who will raise questions, request clarifications, or ask for additional documentation. Prompt, thorough responses to these inquiries keep your application moving forward. Having an experienced HUD lender managing this communication is invaluable, as they understand what underwriters need and can often anticipate questions before they're asked.

Phase Four: Firm Commitment (Weeks 25-28)

Assuming your project successfully navigates underwriting, HUD will issue a firm commitment—their formal offer to provide financing subject to specific conditions.

Understanding Your Firm Commitment The firm commitment letter outlines the exact loan amount, interest rate, and terms, along with specific conditions you must satisfy before closing. Common conditions include obtaining necessary local permits and approvals, finalizing construction contracts and bonding, establishing required reserve accounts, and providing updated financial information.

Review your firm commitment carefully with your legal counsel and lender. Ensure you understand every condition and begin working immediately to satisfy them. The firm commitment typically provides 60-90 days to meet all conditions and proceed to closing.

Phase Five: Closing Preparation and Final Execution (Weeks 29-32+)

The final phase involves satisfying all firm commitment conditions, finalizing loan documents, and coordinating all parties for a successful closing.

Satisfying Commitment Conditions Work systematically through each condition in your firm commitment. Obtain final building permits, execute construction contracts, establish escrow accounts for taxes, insurance, and reserves, finalize title work and surveys, and obtain required insurance policies.

Loan Document Preparation Your lender, working with HUD and legal counsel, prepares comprehensive loan documentation including the mortgage note, deed of trust or mortgage, regulatory agreements, and escrow agreements. For construction loans, documents also include construction contracts, payment and performance bonds, and architect's certifications.

The Closing HUD loan closings are typically more complex than conventional commercial closings due to the number of parties involved and extensive documentation. Plan for a closing that may take several hours and involve your team, HUD representatives (often appearing via counsel), title company representatives, and legal counsel for all parties.

For construction loans, closing involves establishing the construction escrow account and payment procedures. You won't receive all proceeds immediately; instead, funds will be disbursed on a draw basis as construction progresses and is verified by HUD inspectors.

Timeline Expectations: Setting Realistic Goals

Understanding realistic timeframes helps you plan effectively:

HUD 223(f) (existing properties): 5-7 months from application to closing

HUD 221(d)(4) (new construction): 9-12+ months from application to construction closing

HUD 232 (healthcare facilities): 8-12 months depending on project type and complexity

These timelines assume a well-prepared application with experienced team members and responsive borrowers. Incomplete applications, inexperienced borrowers, or complex projects can extend timelines significantly.

Keys to a Successful HUD Financing Experience

Success with HUD financing comes down to several critical factors. Start early and plan for realistic timelines—don't pursue HUD financing if you need to close in 90 days. Engage experienced professionals who understand HUD's requirements and processes. Prepare complete, thorough documentation from the outset. Respond promptly to all requests for information or clarification. Maintain realistic expectations about timelines and be patient with the process.

Is the Process Worth It?

While HUD financing requires significant upfront effort and patience, the long-term benefits—including high leverage, long-term fixed rates, non-recourse structure, and assumably—often make it the optimal choice for quality multifamily and healthcare projects. The discipline that HUD's process requires often results in better-planned, more thoughtfully executed projects that perform well over the long term.

Approach HUD financing as a partnership rather than a transaction. HUD's rigorous process exists to protect both taxpayers and borrowers, ensuring that financed projects have strong fundamentals and appropriate capital structures. By understanding and embracing this process, you position yourself for long-term success in commercial real estate development and investment.

Renaissance Capital Group

Discover Profitable Property Investment Your trusted partner in property investment. From acquisitions to renovations and management, we help you grow your portfolio and maximize returns effortlessly.

Realize Your Vision, Own The Space.

Claude R. Trotter, III

Renaissance Capital Group exceeded expectations on our DFW commercial project. Their fantastic team communicated brilliantly and worked tirelessly through challenges, delivering on time and on budget. Highly recommend!

Dr. Andrea Long-Nelson

Our school facility project exceeded expectations thanks to Renaissance Capital Group. Their team understood educational needs, communicated clearly with administration, and navigated regulatory challenges seamlessly. Delivered on schedule and budget—trustworthy partners.

Gabe Monticue

I've worked with Dr. David L. Willis at Renaissance Capital Group for years, and his authenticity and real estate expertise are unmatched. David consistently keeps his word, demonstrating integrity in every interaction. His client commitment makes him invaluable.

Get In Touch

Email: [email protected]

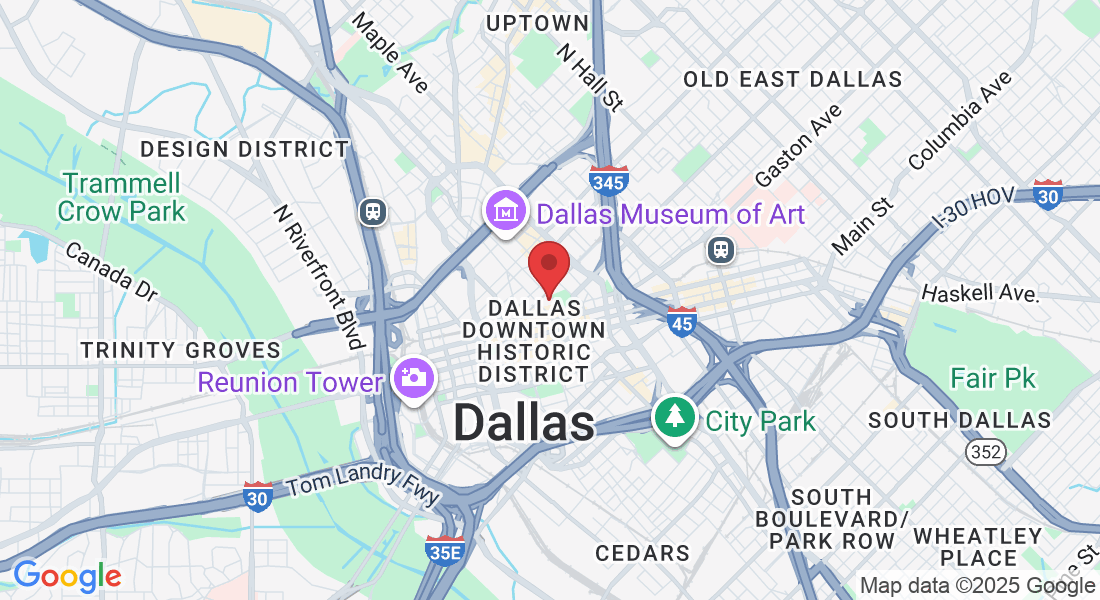

Address

Office: 325 North St. Paul, Suite 3100, Dallas Texas 75201

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

(972) 896-0381

Realize Your Vision, Own The Space.

Turn your vision into reality. Own the space.

© 2026 Renaissance Capital Group - All Rights Reserved. Invest Smart, Grow Strong, Build Your Future. Website created by EBA - Education & Business Automation