See Our Latest Blogs

Explore expert insights, tips, and updates in our latest property investment blog posts.

The Hidden Benefits of HUD 232 Loans for Healthcare Real Estate Investors

While most real estate investors are familiar with HUD's multifamily financing programs, the HUD 232 loan program remains one of commercial real estate's best-kept secrets. Specifically designed for healthcare facilities including nursing homes, assisted living facilities, memory care units, and board and care homes, this program offers unique advantages that make it exceptionally attractive for healthcare real estate development and acquisition.

As America's population ages and demand for senior housing and healthcare facilities continues to grow, understanding HUD 232 financing has become increasingly critical for investors and developers in this sector. Let's explore the often-overlooked benefits that make this program a game-changer for healthcare real estate.

What Makes HUD 232 Unique in Healthcare Financing

The HUD 232 program is specifically tailored to address the unique challenges of healthcare facility financing. Unlike conventional commercial loans that may not fully appreciate the nuances of healthcare operations, or multifamily programs that don't account for healthcare regulations and revenue models, HUD 232 was purpose-built for this asset class.

The program finances both new construction and substantial rehabilitation through HUD 232/223(f) for existing facilities and HUD 232 new construction and substantial rehabilitation programs. This dual approach gives investors flexibility to pursue various strategies within the healthcare real estate sector.

What truly distinguishes HUD 232 is its understanding that healthcare facilities operate differently from traditional real estate. The program's underwriting considers Medicare and Medicaid reimbursement rates, state licensing requirements, and the specialized operational needs that characterize senior housing and healthcare facilities.

Exceptional Leverage Opportunities

One of HUD 232's most compelling features is its loan-to-cost and loan-to-value ratios. For new construction and substantial rehabilitation, the program offers up to 90% leverage, with possibilities for even higher leverage when combined with other programs or in specific market conditions.

For skilled nursing facilities and other eligible healthcare properties, this means you can develop or acquire substantial projects while preserving significant capital for other opportunities or operational reserves. In an industry where regulatory requirements and startup costs can be substantial, this high leverage provides crucial flexibility.

The program's definition of eligible costs is comprehensive, covering not only construction and acquisition expenses but also architectural fees, legal costs, financing fees, and even an appropriate developer fee. This all-encompassing approach to eligible costs ensures your financing covers the full spectrum of project needs.

Long-Term Stability Through Extended Terms

HUD 232 loans feature some of the longest available terms in commercial real estate, with amortization periods up to 35 years for substantial rehabilitation and refinancing, and even longer terms available for new construction projects. These extended terms provide multiple strategic advantages for healthcare facility operators.

Lower monthly debt service payments relative to shorter-term loans improve cash flow during the critical early operational years when facilities are building census and establishing relationships with referral sources. In the healthcare sector, where occupancy ramp-up can take longer than traditional multifamily properties, this extended stabilization runway is invaluable.

The long-term fixed rates protect against interest rate volatility, a particularly important consideration for facilities dependent on relatively stable Medicare and Medicaid reimbursement rates. Your debt service remains constant even as you navigate changes in reimbursement rates, labor costs, and regulatory requirements.

Non-Recourse Structure: Protecting Personal Assets

Like other HUD programs, HUD 232 loans are generally non-recourse, meaning the lender's recourse is limited to the property itself rather than extending to the borrower's other assets. For healthcare facility investors and developers, this protection is particularly valuable given the regulatory complexity and operational risks inherent in the healthcare industry.

The non-recourse feature allows you to compartmentalize risk on a facility-by-facility basis, protecting your broader portfolio and personal assets from challenges that may arise at any individual property. This becomes especially important for growing healthcare real estate portfolios where you're operating multiple facilities across different markets.

Personal guarantees are typically limited to specific "bad boy" carve-outs such as fraud, waste, environmental violations, or misappropriation of funds, rather than extending to normal business operations or industry-specific challenges.

Assumability: A Powerful Exit Strategy Tool

HUD 232 loans are assumable, subject to FHA approval of the new borrower. This feature creates significant value at the time of sale, as qualified buyers can take over your financing rather than having to secure new loans in whatever interest rate environment exists at disposition.

In healthcare real estate, where properties often trade between sophisticated operators, the ability to offer assumable financing can differentiate your property in the market. Buyers may be willing to pay premium prices to acquire not just a physical facility, but also favorable, long-term financing that's already in place.

This assumability is particularly valuable in rising rate environments, where your locked-in rate from years earlier may be substantially more favorable than current market rates, effectively making your financing itself an asset that enhances the property's value.

Understanding Medicare and Medicaid Certification Requirements

A critical aspect of HUD 232 financing involves understanding the interaction between FHA requirements and Medicare/Medicaid certification. HUD recognizes that facilities receiving reimbursements from these federal programs represent lower operational risk due to the reliability of government payments.

Facilities that are Medicare and Medicaid certified typically receive favorable treatment in the underwriting process, as these certifications demonstrate regulatory compliance and provide stable revenue sources. HUD underwriters understand the healthcare reimbursement system and factor this stability into their risk assessment.

For developers planning new facilities, understanding the timeline and requirements for obtaining these certifications is crucial, as they directly impact your property's operational viability and loan serviceability once construction is complete.

Specialized Underwriting for Healthcare Operations

HUD 232 underwriting goes beyond typical real estate metrics to consider healthcare-specific factors. Underwriters evaluate state certificate of need requirements, local market demographics, competitive supply analysis, and projected Medicare and Medicaid reimbursement rates.

This specialized approach means your project is evaluated by professionals who understand healthcare real estate, rather than trying to force a healthcare facility into a conventional commercial loan framework. The process considers occupancy ramp-up schedules appropriate for healthcare facilities, typical operating expense ratios for different facility types, and the impact of acuity mix on revenue.

While this specialized underwriting requires more detailed information and longer processing times than conventional loans, it ultimately results in more appropriate financing structures that align with how healthcare facilities actually operate and perform.

Market Demographics and Demand Analysis

HUD requires comprehensive market studies for 232 financed projects, examining local demographics, age-qualified population, income levels, and competitive supply. These market studies, while adding to upfront costs, provide valuable validation of your project's feasibility and help identify potential operational challenges before construction begins.

The demographic analysis looks at current and projected populations of seniors aged 75+, 80+, and 85+ depending on your facility type, household income distributions, and local healthcare infrastructure. This data-driven approach to feasibility helps ensure that financed facilities have strong fundamental demand profiles.

For investors, these required studies serve dual purposes: they satisfy HUD's underwriting requirements while providing you with institutional-quality market research that informs your operational strategy and helps establish credibility with equity partners.

Is HUD 232 Right for Your Healthcare Project?

HUD 232 financing is ideal for developers and investors committed to healthcare real estate who can navigate the program's comprehensive requirements and longer processing times. If you're developing or acquiring nursing homes, assisted living facilities, board and care homes, or intermediate care facilities, and you value long-term stability, high leverage, and non-recourse financing, this program deserves serious consideration.

The combination of specialized healthcare underwriting, extended terms, assumability, and competitive rates makes HUD 232 one of the most powerful tools available in healthcare real estate finance. While the program requires patience and thorough preparation, the long-term benefits of securing optimal financing for your healthcare facility investment can significantly enhance your project's success and your portfolio's growth trajectory.

Renaissance Capital Group

Discover Profitable Property Investment Your trusted partner in property investment. From acquisitions to renovations and management, we help you grow your portfolio and maximize returns effortlessly.

Realize Your Vision, Own The Space.

Claude R. Trotter, III

Renaissance Capital Group exceeded expectations on our DFW commercial project. Their fantastic team communicated brilliantly and worked tirelessly through challenges, delivering on time and on budget. Highly recommend!

Dr. Andrea Long-Nelson

Our school facility project exceeded expectations thanks to Renaissance Capital Group. Their team understood educational needs, communicated clearly with administration, and navigated regulatory challenges seamlessly. Delivered on schedule and budget—trustworthy partners.

Gabe Monticue

I've worked with Dr. David L. Willis at Renaissance Capital Group for years, and his authenticity and real estate expertise are unmatched. David consistently keeps his word, demonstrating integrity in every interaction. His client commitment makes him invaluable.

Get In Touch

Email: [email protected]

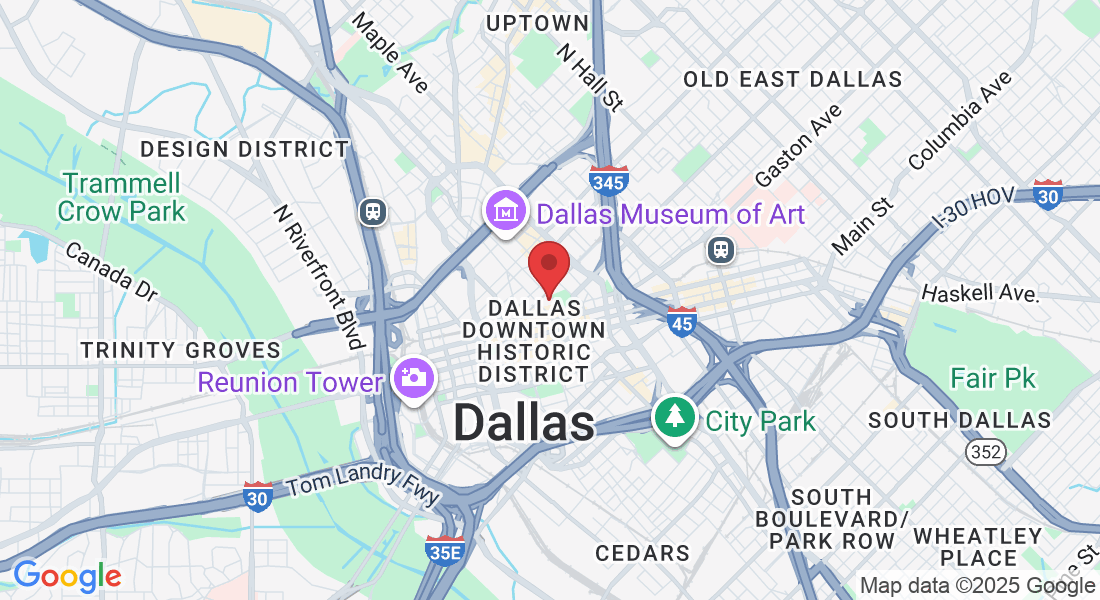

Address

Office: 325 North St. Paul, Suite 3100, Dallas Texas 75201

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

(972) 896-0381

Realize Your Vision, Own The Space.

Turn your vision into reality. Own the space.

© 2026 Renaissance Capital Group - All Rights Reserved. Invest Smart, Grow Strong, Build Your Future. Website created by EBA - Education & Business Automation