See Our Latest Blogs

Explore expert insights, tips, and updates in our latest property investment blog posts.

5 Reasons Why Experienced Developers Choose HUD 221(d)(4) for Multifamily Construction

As a seasoned developer, you've likely explored countless financing options for your multifamily projects. While conventional construction loans and bridge financing have their place, there's a reason why sophisticated developers consistently turn to HUD 221(d)(4) for new construction and substantial rehabilitation projects. This program offers a unique combination of benefits that can significantly enhance your project's financial performance and long-term value. Here are five compelling reasons why HUD 221(d)(4) should be at the top of your financing consideration list.

1. Unmatched Non-Recourse Financing Structure

One of the most powerful features of HUD 221(d)(4) financing is its non-recourse structure. Unlike most construction loans that require personal guarantees throughout the entire loan term, HUD financing limits your personal exposure to specific "bad boy" carve-outs such as fraud, misrepresentation, or environmental violations.

For experienced developers managing multiple projects simultaneously, this protection is invaluable. It allows you to compartmentalize risk on a per-project basis, protecting your personal assets and other portfolio holdings. This becomes particularly advantageous when you're scaling your development business and want to pursue multiple opportunities without exponentially increasing your personal liability.

The non-recourse feature also makes it easier to bring in equity partners who appreciate the limited liability structure. Institutional investors and family offices often prefer HUD-financed projects precisely because of this risk mitigation, potentially improving your ability to raise capital for future developments.

2. Maximum Leverage at 90% Loan-to-Cost

Capital efficiency is paramount in development, and HUD 221(d)(4) delivers some of the highest leverage available in the market. With the ability to finance up to 90% of eligible project costs (and even higher for affordable housing projects), you can preserve capital for other opportunities while still moving forward with substantial developments.

This high leverage means you can potentially develop more projects with the same amount of equity, accelerating your portfolio growth. For a $50 million development, the difference between 75% and 90% leverage represents $7.5 million in equity that can be deployed elsewhere or kept as reserves for unexpected opportunities.

The program's comprehensive approach to eligible costs is equally impressive. Beyond hard construction costs, you can finance soft costs including architectural fees, legal expenses, developer fees, and even interest reserves during construction. This holistic approach to financing ensures your capital planning is streamlined and efficient.

3. Long-Term Fixed Rates That Lock in Today's Advantage

Market timing is everything in development, and HUD 221(d)(4) allows you to lock in permanent financing terms during the construction phase. With loan terms up to 40 years and fixed interest rates based on Treasury yields plus a spread, you're securing permanent financing at the moment you commit to construction—not two years later when your project stabilizes.

This forward-thinking structure eliminates the refinancing risk that plagues many conventional construction-to-permanent transitions. You won't face the uncertainty of having to secure takeout financing in a potentially higher interest rate environment. For developers who have experienced market cycles, this certainty is worth its weight in gold.

The long amortization period also enhances your project's cash flow during the critical early stabilization years. With lower debt service payments relative to shorter-term loans, you have more breathing room to achieve optimal occupancy and rental rates without financial pressure forcing premature decisions.

4. Flexible Project Types and Sizes

Whether you're developing a 50-unit garden-style apartment community or a 300-unit high-rise urban project, HUD 221(d)(4) accommodates a wide range of development types. The program works for market-rate, affordable, senior, and mixed-income housing, giving you flexibility in choosing projects that match current market opportunities.

The minimum loan amount of $2 million makes it accessible for mid-sized developments, while the program's ability to finance projects exceeding $100 million supports major urban infill developments. This scalability means you can use the same financing structure as you grow your development business from regional projects to major metropolitan developments.

Geographic flexibility is another advantage. Unlike some state-specific programs or local incentives with restricted geographic footprints, HUD 221(d)(4) is available nationwide, allowing you to pursue opportunities in emerging markets without having to completely restructure your financing approach.

5. Enhanced Exit Strategy and Asset Value

Properties financed with HUD 221(d)(4) loans often command premium valuations in the sale market. Sophisticated buyers recognize the value of assumable, low-leverage, long-term fixed-rate debt. This assumability feature can be a powerful selling point when you're ready to exit the investment, potentially expanding your buyer pool and supporting higher sale prices.

The financing structure itself becomes an asset feature. Buyers can assume your favorable terms rather than having to secure new financing in whatever interest rate environment exists at the time of sale. In rising rate environments, this can create significant value enhancement for your exit strategy.

Additionally, the rigorous HUD approval process and ongoing compliance requirements signal to the market that your property meets high quality and operational standards. This institutional validation can enhance your reputation as a developer and make future projects easier to finance and sell.

The Bottom Line for Developers

While HUD 221(d)(4) financing requires more upfront time and documentation than conventional construction loans—typically six to nine months from application to initial closing—the long-term benefits far outweigh the additional effort for experienced developers with quality projects.

The combination of non-recourse financing, maximum leverage, long-term fixed rates, project flexibility, and enhanced exit strategies creates a financing structure that supports both project success and portfolio growth. For developers committed to building high-quality multifamily properties with strong fundamentals, HUD 221(d)(4) isn't just an option—it's often the optimal choice.

As you evaluate your next development opportunity, consider whether the discipline and structure that HUD financing requires might actually enhance your project's success rather than constrain it. The most successful developers aren't just building properties; they're building sustainable, scalable businesses—and HUD 221(d)(4) provides a financing foundation that supports that vision.

Realize Your Vision, Own The Space.

Claude R. Trotter, III

Renaissance Capital Group exceeded expectations on our DFW commercial project. Their fantastic team communicated brilliantly and worked tirelessly through challenges, delivering on time and on budget. Highly recommend!

Dr. Andrea Long-Nelson

Our school facility project exceeded expectations thanks to Renaissance Capital Group. Their team understood educational needs, communicated clearly with administration, and navigated regulatory challenges seamlessly. Delivered on schedule and budget—trustworthy partners.

Gabe Monticue

I've worked with Dr. David L. Willis at Renaissance Capital Group for years, and his authenticity and real estate expertise are unmatched. David consistently keeps his word, demonstrating integrity in every interaction. His client commitment makes him invaluable.

Get In Touch

Email: [email protected]

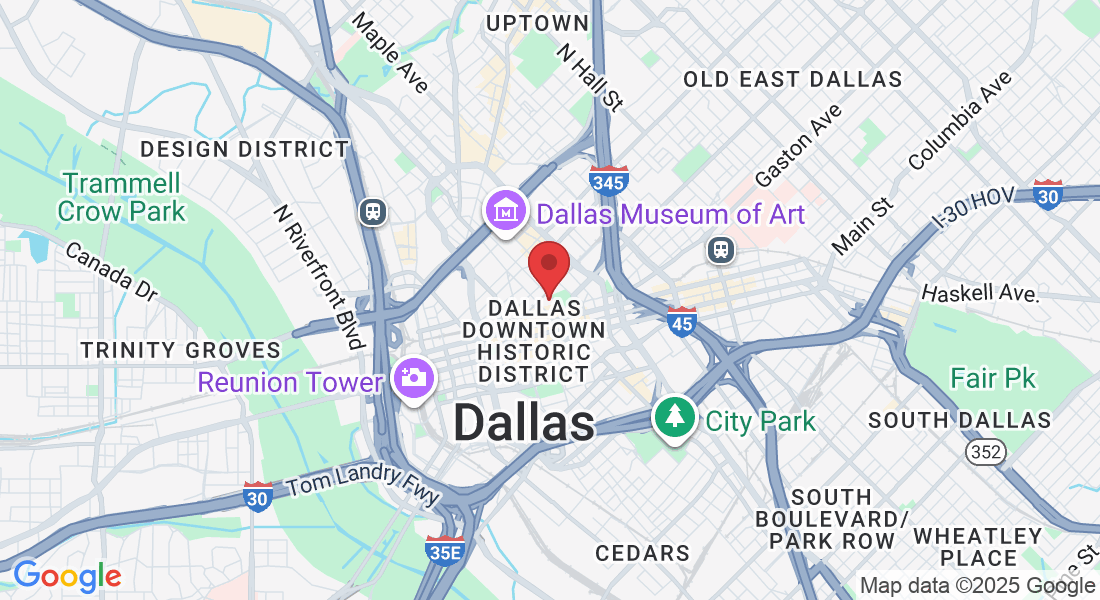

Address

Office: 325 North St. Paul, Suite 3100, Dallas Texas 75201

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

(972) 896-0381

Realize Your Vision, Own The Space.

Turn your vision into reality. Own the space.

© 2026 Renaissance Capital Group - All Rights Reserved. Invest Smart, Grow Strong, Build Your Future. Website created by EBA - Education & Business Automation